There has been a dramatic decrease in life expectancy in the past few years. In August 2022, the Centers for Disease Control and Prevention, better known as the CDC, announced that life expectancy at birth in the U.S. is 76.1 years. This is 2.7 years shorter than it was just prior to the advent of COVID-19.

Yet COVID isn’t the only cause of this diminishing life expectancy. Mortality rates associated with drug overdose, accidental injury, heart disease, liver disease, and suicide, among other causes, are also rising.

At Miller & Newberg, as the fourth largest annuity and life insurance actuarial firm in North America serving many client insurance companies and fraternal benefit societies, we have very credible data when it comes to insured lives mortality. We compile and analyze this data to help our clients make wise decisions regarding their businesses.

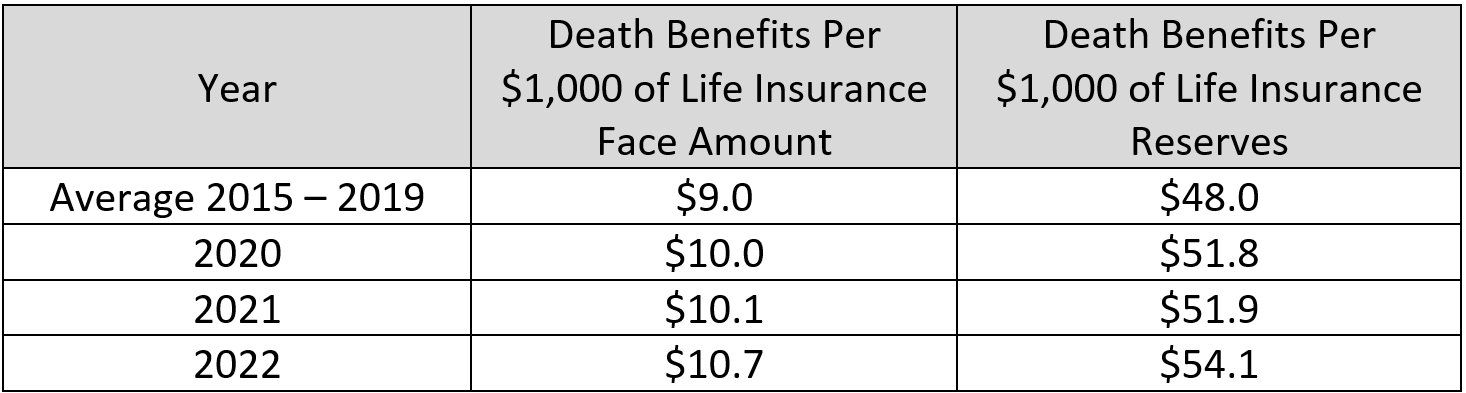

No matter how you look at it, our client insurers are seeing their overall death claims continue to climb, even as COVID recedes. You may be surprised to learn that 2022 was a worse claims year due to mortality than both 2020 and 2021. See the chart below:

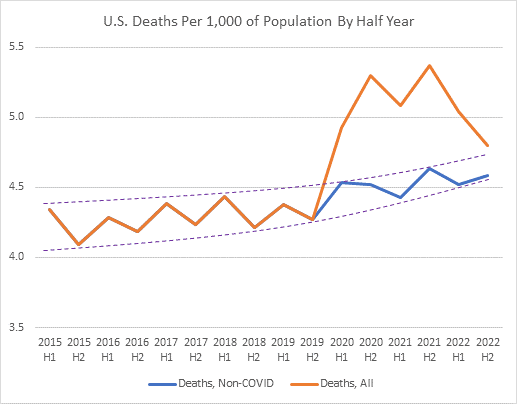

As to population mortality, the latest data from the CDC is showing that overall mortality is decreasing because COVID is receding. But notice in the graph below that the non-COVID death rate is climbing noticeably.

With the non-COVID level of mortality worsening, how should companies react? We have not seen significant changes to pricing by either insurers or reinsurers. Some companies are simply hoping that the trend will reverse, but we advise that hope is not often a good strategy.

Some companies are attempting to address this challenge through the underwriting process. Other companies are working to grow their annuity business more aggressively than their life insurance business. There are other approaches that could make sense. We work with our clients to tailor solutions that meet their needs, specific to their desires and circumstances.

If you’re concerned about the mortality your company is seeing, give us a call. Miller & Newberg remains vigilant in tracking the data and helping our clients to make the best decisions that help them grow their businesses profitably.